State of Connecticut Department of Banking Foreclosure Hotline describes how to avoid foreclosure

The information included here describes a framework for the foreclosure process. It is provided by the Connecticut Fair Housing Center and may not be applicable in all states. For your state information to avoid foreclosure click here.

Understanding the Foreclosure Process and How to Avoid Foreclosure

Module 1: The Process

The foreclosure process can be a daunting and stressful experience for homeowners. By understanding the process and knowing your options, you can work to avoid foreclosure and protect your financial well-being. In this blog post, we’ll explore the foreclosure process, pre-foreclosure, and foreclosed properties, as well as offer some tips on how to avoid foreclosure.

The Foreclosure Process

- Step 1: Default

- A homeowner falls behind on mortgage payments and enters a state of default.

- Step 2: Notice of Default

- The lender files a public notice, known as a Notice of Default (NOD), to begin the foreclosure process.

- Step 3: Pre-Foreclosure

- The homeowner has a period of time to remedy the default, usually between 90 and 120 days.

- Step 4: Auction

- If the homeowner cannot remedy the default, the property is auctioned off to the highest bidder.

- Step 5: REO or Bank-Owned Property

- If the property isn’t sold at auction, it becomes a Real Estate Owned (REO) or bank-owned property.

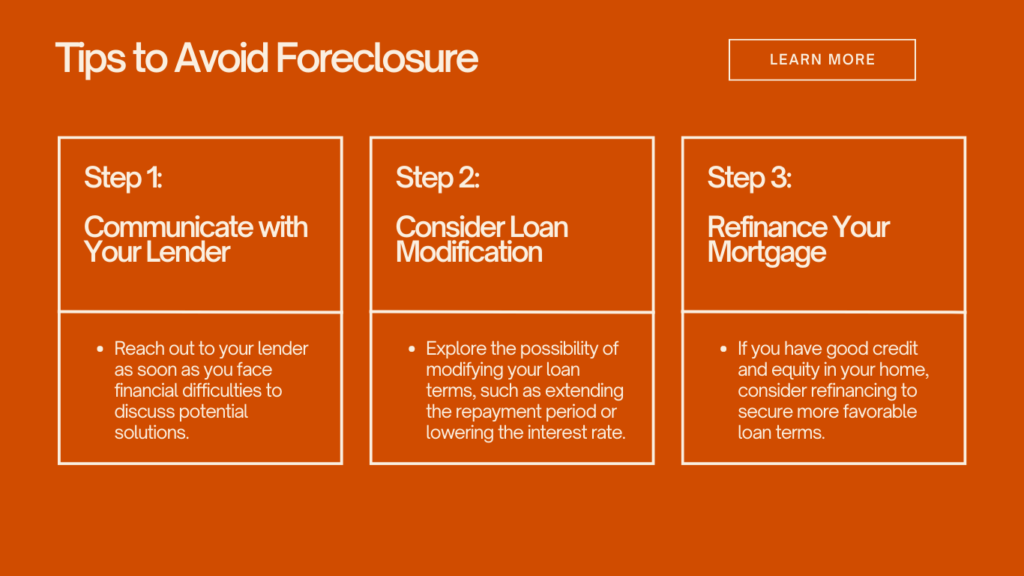

Tips to Avoid Foreclosure

- Communicate with Your Lender

- Reach out to your lender as soon as you face financial difficulties to discuss potential solutions.

- Consider Loan Modification

- Explore the possibility of modifying your loan terms, such as extending the repayment period or lowering the interest rate.

- Refinance Your Mortgage

- If you have good credit and equity in your home, consider refinancing to secure more favorable loan terms.

- Apply for a Forbearance

- Request temporary suspension or reduction of your mortgage payments to provide time to improve your financial situation.

- Sell Your Home

- If you have equity in your home, consider selling it to avoid foreclosure before the foreclosure process starts to avert negative credit impacts.

Pre-Foreclosure: What It Is and How to Benefit from It

Pre-foreclosure is a stage in the foreclosure process that offers opportunities for both homeowners and investors. In this blog post, we’ll discuss what pre-foreclosure is, how it can benefit homeowners looking to avoid foreclosure, and how investors can capitalize on pre-foreclosure properties.

Defining Pre-Foreclosure

- Pre-foreclosure begins after the lender files a Notice of Default and lasts until the property is sold at auction or becomes bank-owned.

- During this period, homeowners have a chance to cure the default or sell the property to satisfy the outstanding debt.

Benefits for Homeowners

- Opportunity to Cure Default

- Homeowners have a chance to bring their mortgage current or work out a repayment plan with the lender.

- Short Sale

- Homeowners can sell the property for less than the outstanding debt to avoid foreclosure and minimize credit damage.

Understanding the Role of Foreclosure Counseling in Avoiding Foreclosure

Foreclosure counseling can be a valuable resource for homeowners struggling to keep up with their mortgage payments. In this blog post, we’ll discuss the role of foreclosure counseling in helping homeowners avoid foreclosure.

What is Foreclosure Counseling?

- Foreclosure counseling is a service provided by certified housing counselors who help homeowners understand their options and navigate the foreclosure process.

- Counselors can help homeowners develop a budget, communicate with lenders, and explore available foreclosure prevention options to avoid foreclosure.

Benefits of Foreclosure Counseling to Avoid Foreclosure

- Expert Guidance

- Counselors have specialized knowledge of the foreclosure process and can help homeowners make informed decisions.

- Budgeting Assistance

- Counselors can help homeowners create a budget to better manage their finances and prioritize mortgage payments.

- Loan Modification Assistance

- Counselors can help homeowners understand the requirements and application process for loan modification programs.

- Referral to Resources

- Counselors can connect homeowners with local, state, and federal resources to assist in avoiding foreclosure and ultimately achieve their financial goals. Whether you’re a homeowner seeking to avoid foreclosure or an investor looking for a profitable opportunity, knowledge and preparation are key to navigating the complexities of foreclosures.

Strategies for Avoiding Foreclosure Scams

Unfortunately, homeowners facing foreclosure can become targets for scammers looking to profit from their vulnerable situation. In this blog post, we’ll discuss strategies for avoiding foreclosure scams and protecting your finances.

Common Foreclosure Scams

- Phony Counseling Agencies

- Scammers pose as foreclosure counselors and charge high fees for nonexistent or ineffective services.

- Bait-and-Switch

- Homeowners are tricked into signing over the deed to their home, believing they’re signing a loan modification or other relief document to avoid foreclosure.

- Rent-to-Buy Schemes

- Scammers convince homeowners to sign over the deed to their property with the promise of leasing it back to them and eventually allowing them to repurchase the home.

Tips to Avoid Foreclosure Scams

- Research Counseling Services

- Only work with certified housing counselors from reputable organizations, such as those approved by the U.S. Department of Housing and Urban Development (HUD).

- Avoid Upfront Fees

- Be wary of any organization that demands a large upfront fee for foreclosure assistance services.

- Read and Understand Documents

- Carefully read and ensure you understand any documents you sign, and consider having a trusted attorney review them.

- Verify Credentials

- Verify the credentials and licenses of any professionals you work with, including real estate agents, attorneys, and counselors.

- Report Suspicious Activity

- Report any suspicious activity or suspected scams to your local consumer protection agency or state attorney general’s office.

By staying informed and vigilant, homeowners can protect themselves from foreclosure scams and successfully navigate the foreclosure process with confidence.

In conclusion, understanding the foreclosure process, pre-foreclosure, and foreclosed properties is crucial for both homeowners and investors. By being proactive and utilizing available resources, homeowners can avoid foreclosure, and investors can capitalize on profitable opportunities. Remember to always stay informed, ask for help when needed, and take advantage of the wealth of knowledge and assistance available to successfully navigate the complex world of foreclosures.

Foreclosure Prevention Course

Module 2: Three tracks for homeowners to manage simultaneously to avoid foreclosure

Lesson 1: Notice of Intent to Accelerate – First indication of a Foreclosure Lawsuit

- A letter from the lender asking to pay all missed payments within 30 days or the whole amount becomes due

- Lender must still take the homeowner to court if payments aren’t made

- Receiving letters from lender’s attorney doesn’t necessarily mean foreclosure yet

- Foreclosure Lawsuit starts when served with a summons and complaint package by a Marshall

- Be aware of deadlines for completing return file forms

Lesson 2: The Lawsuit – Filed by the lender in court to request permission to foreclose and take the house

- Usually occurs when three months or more behind on payments

- Keep track of:

- Court dates

- Documents filed by the lender in court

- Response deadlines

- Use a calendar and personal foreclosure record to log:

- Correspondence or phone calls received/sent

- Dates and times of interactions

- Contacts at the bank (name, phone number, email)

- Mediation Counselor (name, phone number, email)

- Court conversations (names, dates, and times)

Lesson 3: Foreclosure Mediation Program – Part of the court process but separate from the Lawsuit

- Goal: Determine if there’s a way to avoid foreclosure by reaching an agreement between the homeowner and lender

- Eligibility: Only when the Foreclosure Lawsuit has started

- Foreclosure Mediation puts up to an eight-month hold on the foreclosure lawsuit

- Lender cannot foreclose or advance the process against the homeowner during this time

- Lender must focus on working with the homeowner in mediation

- Success rate for foreclosure mediation is high

- Most homeowners reach an agreement to avoid foreclosure

- Some agreements involve giving up the home, but the majority keep the homeowner in the house

- Mediation can work even if previous attempts to negotiate with the lender failed

- Keep notes on:

- Mediation appointment dates

- Documents the mediation counselor instructs to collect

- Stay organized to prove document submission

- Lender departments handling each track might differ

- Representatives may not know what’s happening in Foreclosure Mediation or the Foreclosure Lawsuit

- Homeowners must take responsibility for tracking and managing all aspects of the process to avoid foreclosure.

Staying Organized and Proactive Throughout the Foreclosure Prevention Process

To successfully navigate the foreclosure prevention process, it’s crucial to stay organized and proactive. Here are some tips to help you manage all three tracks effectively:

- Create a filing system: Keep all foreclosure-related documents, notes, and correspondence in one centralized location, such as a binder or digital folder.

- Maintain a timeline: Record every event, deadline, and interaction related to the foreclosure process. This will help you stay on top of important dates and ensure you’re meeting all requirements.

- Communicate regularly: Maintain open lines of communication with your lender, mediation counselor, and any legal representatives. Keep them informed of any changes in your situation and promptly respond to their inquiries.

- Stay informed: Educate yourself on the foreclosure process and your rights as a homeowner. Familiarize yourself with any laws and regulations that may apply to your case.

- Seek assistance: Don’t hesitate to seek help from professionals or support groups. Many organizations offer free or low-cost foreclosure prevention counseling and resources to avoid foreclosure.

- Be persistent: If you encounter obstacles or setbacks, don’t give up. Continue to advocate for yourself and explore all available options for avoiding foreclosure.

By staying organized, proactive, and persistent throughout the foreclosure prevention process, you’ll be better equipped.

Foreclosure Prevention Course

Module 3: Notice of Intent to Accelerate and Summons and Complaint Package

Lesson 1: Notice of Intent to Accelerate – First indication of a Foreclosure Lawsuit

- After receiving the Summons and Complaint Package, you can request Mediation

- This can halt the foreclosure lawsuit for up to eight months

Lesson 2: Filing the Appearance Form and Foreclosure Mediation Certificate in Court

- The two forms required to file in court are:

- Appearance Form

- Foreclosure Mediation Certificate

- Copies of both forms can be found in the Summons and Complaint Package, at a courthouse, on the court website, or in the Guide to Representing Yourself in Foreclosure

- Deadline to file both forms is 15 days after the return date listed on the Summons

- The return date is not a court date, nor the date you’ll lose your house

- You don’t need to go to court or file or file anything on that date.

- The Return Date starts the 15 days you have to get the two forms into the court.

- The Appearance Form mostly just asks you for your contact information in order to get in touch with you so the

Court knows where to send information to get in touch with you.

- It is important to file so that the court knows that you want to participate in your case.

Foreclosure Prevention Course

Module 4: Foreclosure Mediation Certificate

Lesson: Understanding the Foreclosure Mediation Certificate

The Foreclosure Mediation Certificate is what you need to file in order to get into mediation and get the 8-month halt in the foreclosure process. This form looks much more complicated than it actually is. For 99% of the situations, it is just asking a few yes or no questions to make sure you are eligible for foreclosure mediation. The questions include:

- Is this your home?

- Is it your primary residence?

- Is it a 1 to 4 family home in the state of Connecticut?

- Are you the borrower?

- Is this a mortgage foreclosure?

If you can answer yes to all of these questions, then you are eligible for foreclosure mediation.

Lesson: Filing the Forms and Deadlines to avoid foreclosure

Filing this form and the Appearance Form by the deadline of 15 days after the Return Date will get you into Mediation and the 8-month hold will start. However, there are some situations where the homeowner will not be eligible for Foreclosure Mediation:

- Vacation Homes and Investment Properties that are not the primary residence are not eligible.

- Unpaid municipal taxes or assessments or Condo charges are not eligible.

If you truthfully answer yes to the questions, you will be eligible for foreclosure mediation. Remember, the deadline for submitting the two forms is 15 days after the return date.

Foreclosure Prevention Course: Module 5 – Mediation

Two Phases

Lesson: The goal of mediation

- The goal of mediation is to see if you and your lender can reach an agreement to avoid foreclosure.

- This can be something like a loan modification (called debt restructuring), which would keep you in your home, or it could be a short sale, which is an agreement to leave your home.

- Mediation happens in the courthouse but not in an actual court. The meetings happen in small conference rooms or offices. It is much more informal and more comfortable for homeowners than appearing in a court in front of a judge.

- The mediator is a court employee usually appointed by a judge and is neutral, meaning they are neither your advocate nor the lender’s advocate.

- Mediators are trained in foreclosure laws and all of the programs available to homeowners. Most foreclosure mediators in Connecticut usually mediate foreclosure cases and are very familiar with what homeowners are going through and the struggles they often have with the lender.

- The mediator’s job is to push you and the lender toward an agreement to avoid foreclosure. For you, that may mean pushing you for all of the information that they may need and supplementing it as needed. For the lender, that may mean pushing them to properly review you for all of the programs that are available.

Lesson – Phase one: Pre-meditation Meetings

- Homeowners meet one on one with the mediator to complete the forms and collect the documents needed for the lender to evaluate your request to avoid foreclosure.

- Within about 5 weeks after your return date, you will get a packet of forms and other information about your loan from the lender’s attorney.

- Around the same time, you will get a notice from the court with a date for your first one on one Pre-Mediation meeting with the Mediator.

- Do your best to complete the form and gather the information before the first meeting with the Mediator.

- The Mediator will talk to you more about your situation and help you figure out what else is needed. There may be more than one Pre-Mediation Meeting.

- Once the Mediator is satisfied that you have all of the information your lender needs, the Mediator will send your documents to the lender and you will enter the second phase.

Lesson – Phase two: Mediation Sessions with the Lender

- You’ll get your first Mediation appointment, i.e., a meeting with the Mediator and the Lender’s attorney to try to work something out.

- Usually the Lender will not be present, although there may be another representative on the phone.

- The Mediator has discretion not to refer cases to mediation. For example, if the homeowner is not participating. It is very important to go to your appointments and gather the information the lender needs so that you can stay in mediation, get the benefit of the hold on your foreclosure case, and make your best chance to work something out with your Lender.

- Most, but not all, will reach an agreement which keeps them in their home.

- Fewer than 25% of homeowners in Foreclosure Mediation have a lawyer representing them. If you are representing yourself, then you certainly are not alone.

- Even if you had difficulty working with your lender in the past or if the Lender has previously told you there were no options for you, Mediation may result in you reaching an agreement.

- It is common for homeowners who have been denied for loan modification, sometimes even multiple times, to be approved for Mediation.

- Nothing is guaranteed, but Foreclosure Mediation is usually your best chance to work out a deal with your lender.

Module 6 – The Four “P’s” of Mediation Success

Lesson: The First “P” – Plan to avoid foreclosure

- It’s important to be prepared to explain your story in 30 seconds or less, including:

- What happened

- What you want

- Your plan for getting there

- Give a brief description of what happened and what your hardship was, but don’t go into too much detail

- Emphasize your goal and how you plan to achieve it (e.g., loan modification, short sale, staying in the house until the end of the school year, etc.)

- Example: “I fell behind on my mortgage when my spouse’s hours were cut at work and our income dropped by a third. My goal is to keep the house. I am working with the housing counselor to apply for a loan modification and I am also looking for a second part-time job to increase our income.”

Lesson: The Second “P” – Proof

- Keep detailed notes and bring them to Mediation

- Bring extra copies of all the documents you submitted to the Lender, even if it was a while ago

- Confirm all submissions (e.g., fax confirmation pages) to prove that you submitted the documents

- Be prepared to provide evidence for any missing information or documents

Lesson: The Third “P” – Push to avoid foreclosure

- Don’t accept a “NO” from your Lender until you’ve done some research and understand the reason behind their decision

- Lenders sometimes make mistakes with their mathematical formulas, so double check the numbers they used in evaluating your loan modification request

- Two important numbers to check: your monthly income and home value

- Push back and don’t give up if you think the Lender made a mistake

- Your housing counselor and Mediator can also be helpful in assessing whether the Lender made a mistake

Lesson: The Fourth “P” – Patience

- It’s important to be persistent and to negotiate with your Lender, as the average length of time for a homeowner in Mediation is 9 months

- Mediations are typically scheduled a month or two apart, so it’s important to be proactive and engaged in between sessions

- Call your lender in between mediations, submit documents, and be persistent in trying to resolve the Foreclosure.

- Be patient, as it’s unlikely that you will reach a resolution after the first Mediation session

- The goal is to reach a resolution within 3 Mediation sessions over 7 months, but it may take longer

- Be persistent and continue to negotiate with your Lender to reach a resolution

- The servicer negotiation track continues throughout the Foreclosure and Mediation process, so it’s important to stay engaged and proactive.

Tips for Success in Mediation

- Prepare a brief and concise explanation of your situation and goals

- Keep detailed notes and bring them to Mediation, along with extra copies of all submitted documents

- Don’t accept a “NO” from your Lender until you’ve done some research and understand the reason behind their decision

- Push back if you think the Lender made a mistake and seek help from your housing counselor and Mediator.

- Be patient and persistent, as the process can take several months to reach a resolution to avoid foreclosure.

- Stay engaged and proactive in between Mediation sessions by calling your lender, submitting documents, and continuing to negotiate.

Additional Considerations for Mediation

- Make sure to understand the Foreclosure process and your rights as a homeowner

- Work with a housing counselor or attorney to help you navigate the process and ensure your rights are protected

- Be organized and keep track of all communications and documents related to your Foreclosure and Mediation process

- Be prepared to compromise and be open to different solutions, as the goal is to reach a mutually beneficial resolution for both you and your Lender.

Final Thoughts on Mediation

- Mediation can be a challenging process, but with the right approach, it can also be a valuable opportunity to resolve your Foreclosure and find a solution that works for both you and your Lender.

- By following the four “P’s” of Mediation success (Plan, Proof, Push, Patience), being organized, and seeking help from professionals, you can increase your chances of a successful outcome.

- Remember to stay patient, persistent, and proactive throughout the process, and to always keep your goal in mind. With the right approach, you can successfully navigate the Mediation process and reach a resolution that works for you and your family.

Foreclosure Prevention Course: Module 7 – LAWSUIT – SPECIAL DEFENSES – BE SPECIFIC

Lesson: What to do if Mediation Does Not Work Out

If mediation does not work out and the Foreclosure Lawsuit takes back up, you may want to file an Answer in Special Defenses. However, this is an optional step.

- An Answer is your response to the Lender’s claims.

- A Special Defense is your argument for why you should still be able to win and the Lender should not be able to foreclose, even if you did not make your mortgage payment.

- Both the Answer and the Special Defenses are optional, but it is important to be specific and consult with a lawyer if possible.

- You can find legal resources on the Connecticut Bar Association website: https://www.ctbar.org/public/pro-bono-legal-aid-services

Factors to Consider to avoid foreclosure

- Not all cases will have a special defense. In most situations, the judge will not stop the foreclosure if you are behind on payments, even if the Lender has done something wrong.

- If you raise a Special Defense, the Lender’s attorney fees will be added to your mortgage account, so it is important to carefully assess if you have a defense before pursuing this option.

- Special Defenses need to be specific to your loan and not based on general issues such as the greed of the Lender or technical issues with the mortgage note.

- Personal hardships or harm you would suffer if you lost your home do not generally give you a Special Defense, but the judge may give you extra time in your house at the end of the case.

Examples of Special Defenses

- If the Lender was not honoring a loan modification

- If the Lender was supposed to give mortgage forbearance or a temporary pause on payments but is foreclosing anyway

- If your payments were misplaced or misapplied

Considerations for the Answer

- If there is something wrong with the Lender’s complaint, you may want to raise this in the Answer portion.

Final Thoughts

- Again, the Answer and Special Defenses are optional steps and it is best to consult with a lawyer before filing either.

Special Defenses – Key Points to Remember

- A Special Defense is your argument for why you should still be able to win and the Lender should not be able to foreclose, even if you did not make your mortgage payment.

- Special Defenses need to be specific to your loan and not based on general issues.

- Personal hardships or harm you would suffer if you lost your home do not generally give you a Special Defense.

- Examples of Special Defenses include:

- The Lender was not honoring a loan modification

- The Lender was supposed to give mortgage forbearance or a temporary pause on payments but is foreclosing anyway

- Your payments were misplaced or misapplied

- If you decide to raise a Special Defense, it is important to be specific and consult with a lawyer if possible.

Final Thoughts

- The Answer and Special Defenses are optional steps in a Foreclosure Lawsuit.

- It is important to carefully assess if you have a defense before pursuing this option, as the Lender’s attorney fees will be added to your mortgage account.

- If you need legal assistance, you can find resources on the Connecticut Bar Association website: https://www.ctbar.org/public/pro-bono-legal-aid-services

Considerations Before Filing an Answer or Special Defense

- Assess if you have a defense before pursuing this option.

- Be specific in your Answer or Special Defense.

- Consult with a lawyer if possible.

- Consider the financial impact, as the Lender’s attorney fees will be added to your mortgage account if you raise a Special Defense.

Resources for Legal Assistance

- The Connecticut Bar Association website: https://www.ctbar.org/public/pro-bono-legal-aid-services

In conclusion, if you find yourself in a Foreclosure Lawsuit, it is important to understand your options for responding to the Lender’s claims. Filing an Answer or Special Defense can be a complex process, so it is recommended to carefully assess your situation, be specific in your response, and consult with a lawyer if possible.

Foreclosure Prevention Course: Module 8 – SEEING THE JUDGE

Lesson: What to Expect with a Short Calendar Hearing

If you have to see the judge in court, it will likely be for a Short Calendar hearing.

Short Calendar Hearing

- A Short Calendar hearing is when the judge makes a decision in many foreclosure cases that are scheduled for a court hearing on the same date and time.

- You will receive a notice in the mail to attend court on a specific date, usually on Monday.

- On the Friday before your Short Calendar date, confirm with the court clerk’s office that your case will actually be heard on the specified date.

- If one side files something with the court, the case is automatically scheduled for a Short Calendar hearing, but if that side does not affirm that they want the judge to hear their case, the Short Calendar hearing will not happen.

- To avoid wasting a day in court, always confirm your court date on the Friday before.

Language Interpreter

- If you need a language interpreter, try to request one in advance, as there can sometimes be a shortage.

Short Calendar Hearing for Foreclosure Judgment Motion

- If you have a Short Calendar hearing, it will likely be for a foreclosure judgment motion. This means the Lender is asking the judge to set a date to foreclose on your house.

Preparation for the Short Calendar Hearing

- Confirm your court date with the court clerk’s office on the Friday before.

- If necessary, request a language interpreter in advance.

- Prepare for the hearing by gathering any relevant documentation and considering any arguments or defenses you want to make.

Final Thoughts

The Short Calendar hearing is an important step in the foreclosure process and it is important to be prepared and informed. By confirming your court date, requesting a language interpreter if needed, and preparing for the hearing, you can increase your chances of a successful outcome to avoid foreclosure.

Importance of Representation

It is highly recommended to seek legal representation when facing a Short Calendar hearing, as the process can be complex and the consequences of a decision can be significant. A lawyer can help you understand the legal proceedings, prepare your case, and represent your interests in court.

Resources for Legal Assistance

- The Connecticut Bar Association website: https://www.ctbar.org/public/pro-bono-legal-aid-services

In conclusion, the Short Calendar hearing is an important aspect of the foreclosure process and it is important to be informed and prepared. Confirming your court date, seeking legal representation, and preparing your case can increase your chances of a successful outcome.

Taking Action to Prevent Foreclosure

In addition to preparing for a Short Calendar hearing, it is important to take proactive steps to prevent foreclosure. This may include:

- Communicating with your lender: Explain your financial situation and ask if they can offer a loan modification or other solution.

- Seeking assistance from a housing counseling agency: Organizations such as the Housing and Urban Development (HUD) offer free or low-cost counseling services to homeowners facing foreclosure.

- Reviewing your options: Consider options such as a short sale, deed in lieu of foreclosure, or a loan modification.

- Negotiating with your lender: Consider working with your lender to come to a mutually beneficial solution that allows you to keep your home.

Remember, the key to preventing foreclosure is to take action as soon as possible. The earlier you address the issue, the more options you will have available to you.

Conclusion

The Foreclosure Prevention Course is designed to provide homeowners with information and resources to help prevent foreclosure. The Short Calendar hearing is an important aspect of the foreclosure process and it is important to be informed and prepared. Additionally, taking proactive steps to prevent foreclosure, such as communicating with your lender, seeking assistance from a housing counseling agency, reviewing your options, and negotiating with your lender, can increase your chances of a successful outcome.

If you are facing a Short Calendar hearing or are at risk of foreclosure, it is recommended to seek legal representation and take advantage of the resources available to you. The Connecticut Bar Association website (https://www.ctbar.org/public/pro-bono-legal-aid-services) is a good place to start for information on legal resources.

Stay informed, stay proactive, and take control of your situation. With the right information and support, you can prevent foreclosure and keep your home.

Final Thoughts

Foreclosure can be a stressful and overwhelming experience, but it is important to remember that you have options and resources available to you to avoid foreclosure. By staying informed, taking proactive steps, and seeking legal representation if necessary, you can increase your chances of a successful outcome and prevent foreclosure.

It is important to stay motivated and optimistic, and to remember that you are not alone in this process. There are many organizations and individuals who are dedicated to helping homeowners facing foreclosure, and with their support, you can overcome this challenge and keep your home.

Remember to stay informed and take advantage of the resources available to you, and you will be well on your way to a successful outcome in your foreclosure prevention efforts.

Foreclosure Prevention Course: Module 9

Two Ways Foreclosure Happens in Connecticut

- FORECLOSURE SALE

- An auction where the house is sold to the highest bidder at a set Sale Date determined by the judge.

- This process is uncommon and typically occurs only if the property has significant equity or the US has a lien on it.

- STRICT FORECLOSURE

- A more common process that is quieter than a foreclosure sale.

- The judge sets a date called “LAW DAY,” which is the last day you will be the owner of the house.

- After Law Day, ownership of the house will go to the lender, and you will lose your home.

Important Points to Note to avoid foreclosure

- A Foreclosure Judgment Hearing cannot take place until Mediation is over, even if the eight-month halt of the case is up.

- The Judge has the discretion to determine when the Foreclosure Sale or Law Day will happen, and they may take personal hardship into consideration to give additional time in the home.

- If a Foreclosure Sale Date or Law Day is set in your case, you can go back to court to ask for a delay before it passes.

- The Judge has the discretion to delay the foreclosure up until it happens, but once the Law Day has passed, it is usually too late for the Judge to undo it.

Importance of Taking Action to avoid foreclosure

If a Foreclosure Sale Date or Law Day is set in your case, it is crucial to take action and ask the judge to delay it before it passes. There are options available to delay or stop foreclosure, such as loan modification or refinancing.

Remember that delaying the process will give you more time to explore alternatives and find a solution. Ignoring the problem or hoping it will go away is not a good strategy and can lead to losing your home.

Conclusion

Foreclosure is a difficult and stressful experience, but there are options available to prevent it. Understanding the foreclosure process and taking timely action can help you save your home and protect your future.

If you are facing foreclosure, seek help from a HUD-approved housing counselor or a foreclosure prevention attorney. They can provide guidance and support in navigating the process and finding the best solution for your situation.

Additional Resources

Here are some resources that can help you prevent foreclosure and find assistance:

- HUD-approved housing counseling agencies: They offer free or low-cost counseling services to help homeowners prevent foreclosure. To find a counselor near you, visit HUD’s website or call 1-800-569-4287.

- Connecticut Housing Finance Authority (CHFA): They offer several programs to help homeowners avoid foreclosure, including loan modification, refinance, and financial assistance. To learn more, visit their website or call 860-571-3500.

- Connecticut Department of Banking: They provide information and resources on foreclosure prevention, mortgage assistance, and foreclosure scams. To learn more, visit their website or call 860-240-8170.

- Legal Aid Society of Connecticut: They offer free legal services to low-income individuals facing foreclosure. To learn more, visit their website or call 860-447-0323.

Remember, the key to preventing foreclosure is to take action early and seek help from trusted sources. With the right support and resources, you can overcome this challenge and protect your home.

Final Thoughts

Foreclosure can be a challenging and stressful experience, but it is important to know that there are options available to help you prevent it. By understanding the foreclosure process, seeking help from trusted resources, and taking timely action, you can save your home and protect your future.

Remember that delaying the process will give you more time to explore alternatives and find a solution. Don’t wait until it is too late to take action. Seek help from a HUD-approved housing counselor or a foreclosure prevention attorney as soon as possible.

Finally, stay informed and be proactive in managing your finances and your home. Make a budget, prioritize your expenses, and plan for the future. By taking these steps, you can build a strong financial foundation and secure a brighter future for you and your family.

Foreclosure Prevention Course: Module 10

How to ask for more time in Foreclosure proceedings

- To ask for more time, you would have to file a MOTION TO OPEN JUDGMENT.

- You need to file it with the court and have it heard by the Judge.

- It is important to file before your Law Day passes or the Foreclosure Sale happens; otherwise, it may be too late.

Short Calendar Hearing Date

- If you file a Motion to Open, you would also get a Short Calendar Hearing Date.

- You would need to call the Clerk’s Office the week beforehand (Tuesday through Thursday) and confirm that you want the Judge to hear a case on your Short Calendar Date, called Marking Your Case Ready.

Listen to the Court, not the Lender

- When it comes to a Foreclosure Date, it is very important to listen to what the court tells you is going to happen and not what the Lender is telling you.

- Even if the Lender tells you that the foreclosure is not going to happen, if your Law Day has not been postponed by the court, you may still lose your home.

- When in doubt, File a Motion To Open to protect yourself before the Foreclosure Sale or Law Day passes.

Foreclosure Mediation at Short Calendar Hearing

- In a few courts, Judges also hear requests related to Foreclosure Mediation at Short Calendar Hearing.

- This will typically be if you want more time for Mediation Sessions and the Lender disagrees or if the Lender wants Mediation to end for some reason.

Keep it Short and Focused in Court

- No matter what you bring to court, it is important that you keep everything you say short and focused.

- You should have another thirty-second story ready.

- Lead with what you want and then provide some information about why this should happen.

- Judges make decisions quickly, often in five minutes or less.

- It is a good idea to practice and to write out something beforehand to just read, be brief, stay focused.

Summary

In summary, if you need more time in a Foreclosure proceeding, you can file a Motion to Open Judgment and have it heard by the Judge before your Law Day passes or the Foreclosure Sale happens. It is important to listen to the court and not the Lender when it comes to the Foreclosure Date. Additionally, you should keep everything you say short and focused in court and have a thirty-second story ready. Practicing and writing out your statement beforehand can also be helpful.

By following these guidelines, you can better protect yourself in a Foreclosure proceeding and potentially avoid losing your home.

Foreclosure Prevention Course: Module 11

FAIR LENDING / FAIR SERVICING

Predatory Lending and Lending Discrimination

- Even though Predatory Loans don’t always give homeowners a defense to a foreclosure action, Predatory Lending and Lending Discrimination are on the Connecticut Fair Housing Center’s radar and it is something they are actively working on to stop.

- The Mission of CFHC is to stop discrimination in Connecticut, to combat racial segregation in our cities and towns, and to ensure that all residents have access to the housing of their choice.

Race and National Origin Discrimination in Lending

- Race and National Origin Discrimination often show up in lending as giving Black and Latin borrowers worse loans than white borrowers, even if they were more qualified.

- Examples could be higher interest rates, or just more expensive loans.

- It could also occur as refusing to give loans to Black and Latin borrowers or to lend in neighborhoods where people of color predominantly reside.

- It could also happen when real estate agents or lenders steer homeowners into certain neighborhoods and not others based on their race of national origin.

- All of these forms of discrimination contribute to making Connecticut one of the most segregated states in the nation, where towns and cities right next to each other sometimes have populations that are almost entirely white or almost entirely non-white.

Discrimination in Loan Modification Process

- Discrimination can also show up in the loan modification process.

- For example, Black and Latin borrowers or those that are not fluent in English might be treated worse than white borrowers or borrowers that are fluent in English.

- Sometimes Lenders will refuse to consider public benefits like disability or Social Security or self-employment income, which could be a source of income discrimination or disability discrimination.

Summary

In summary, Fair Lending and Fair Servicing are crucial aspects of homeownership and foreclosure prevention. Discrimination in lending can take many forms, including giving worse loans to Black and Latin borrowers, refusing loans to people of color, and steering homeowners into certain neighborhoods based on race or national origin. Discrimination can also occur during the loan modification process. It is important to be aware of these issues and to work with organizations like the Connecticut Fair Housing Center to combat discrimination and ensure fair access to housing for all residents.

Foreclosure Prevention Course: Module 12

BANKRUPTCY

Bankruptcy and Homeownership

- Many homeowners ask if Bankruptcy could save their homes.

- Usually, it makes sense to start a Bankruptcy after talking to a local experienced foreclosure with a bankruptcy attorney early on.

- You can find bankruptcy lawyers in Connecticut from the website www.nacba.org.

- Bankruptcy will usually not save your house.

- It may get rid of your personal liability to pay the debt, meaning your lender won’t be able to go after your bank account or wages, but it generally won’t get rid of the mortgage itself. That means the Lender can still foreclose.

CHAPTER 13 BANKRUPTCY

- A CHAPTER 13 BANKRUPTCY, a Repayment Plan Bankruptcy, can be an option if your income has fully recovered and you can afford to pay your old mortgage payment plus extra to get you caught back up after three to five years.

CHAPTER 7 BANKRUPTCY

- The more common CHAPTER 7 BANKRUPTCY typically won’t save your house that well, but it can be helpful if you have a lot of other debt like credit cards or medical bills.

Importance of Hiring an Experienced Bankruptcy Attorney

- Either way, bankruptcy is not something you want to do on your own.

- Talk to an experienced bankruptcy attorney and do so early in the process.

Summary

In summary, Bankruptcy is an option that many homeowners consider when facing foreclosure, but it is important to understand its limitations. Bankruptcy may not save your house, but it can eliminate personal liability for the debt and help with other types of debt. A CHAPTER 13 BANKRUPTCY can be an option if your income has fully recovered, and you can afford to pay your old mortgage payment plus extra to get you caught back up. It is essential to talk to an experienced bankruptcy attorney and not try to navigate the process on your own.

Foreclosure Prevention Course: Module 13

SCAMS

Beware of Scammers

- Once you are in the Foreclosure Process and sometimes even before, you will probably start getting letters, e-mails, even phone calls from people and companies offering you all sorts of things.

- Promising a loan modification or promising to refinance or tell you what is wrong with your loan. These are almost certainly scams!

- If it sounds too good to be true, it probably is and it is probably a scam.

- NO ONE can promise you a loan modification. This is ultimately the Lender’s decision.

- Do not pay anyone to get a loan modification. It will not increase your chances.

- There is free help available through HUD and CHFA approved housing counselors.

- These are far better than the for-pay scammers that promise to do this for you.

- If you think you have been scammed, you can make a complaint to the Connecticut Department of Banking. The phone number is 877-472-8313.

Forensic Audits

- Also, watch out for FORENSIC AUDITS.

- These companies often promise to tell you, for a fee of course, what is supposedly wrong with your loan.

- But as we talked about, this isn’t going to be a defense in Connecticut, and any real problems with your loan are not something the scammer is going to be able to uncover.

- Unfortunately, many scammers are out of state lawyers or are posing as such.

- It is a crime to practice law in Connecticut without a license.

- Do not hire an out-of-state lawyer not licensed in the state.

- Hire someone local, licensed, experienced in foreclosure defense, and willing to go to court for you.

Summary

In summary, Scammers often prey on homeowners facing foreclosure, promising loan modifications or foreclosure defense services for a fee. It is important to be aware that NO ONE can promise you a loan modification, and there is free help available through HUD and CHFA approved housing counselors. Beware of forensic audit companies that promise to uncover problems with your loan for a fee, as these are often scams. It is crucial to hire a licensed, experienced foreclosure defense attorney who is willing to go to court for you and to report any suspected scams to the Connecticut Department of Banking.